Using data annotation expertise to deliver AI-enabled applications and predictive analytics for banking and finance, driving efficiency, lowering costs, and ensuring financial sustainability.

By integrating our data annotation and NLP expertise into banking and financial services, we enhance productivity and enable AI-powered predictive analytics to support fair and inclusive credit and risk management.

Digital KYC Verification involves trained content teams reviewing data from diverse sources to ensure accuracy, identify inconsistencies, and support companies in meeting compliance requirements while strengthening fraud detection.

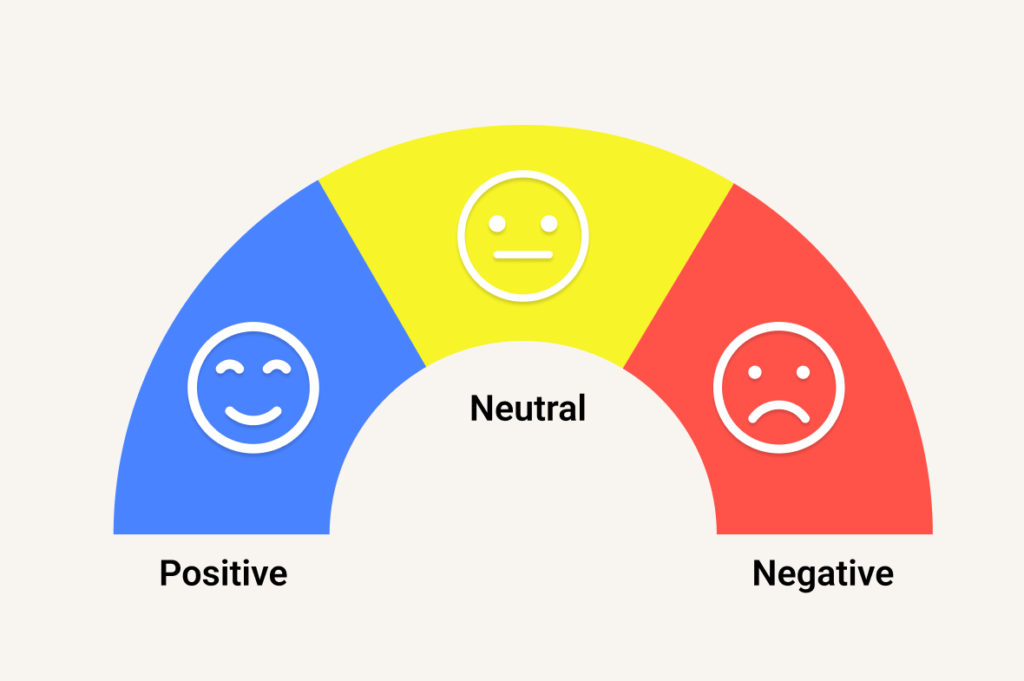

By analyzing historical behaviors and predicting future outcomes, AI empowers banks to forecast market movements, detect lending trends, and personalize financial service recommendations. The following examples highlight AI’s impact on banking and finance:

Coral Mountain Data’s experts combine data annotation and language expertise to build AI-powered financial applications capable of analyzing transaction patterns, ensuring compliance, and delivering in-depth credit and debit analyses.

By leveraging our data excellence, artificial intelligence can help banks reduce costs through automation, enhance customer service, and support smarter decision-making with predictive modeling and image recognition.

Coral Mountain Data’s Natural Language Processing team helps you automate repetitive tasks—such as reporting and reconciliation—by extracting key information from documents including invoices, expenses, credit, shipping, and tax records.

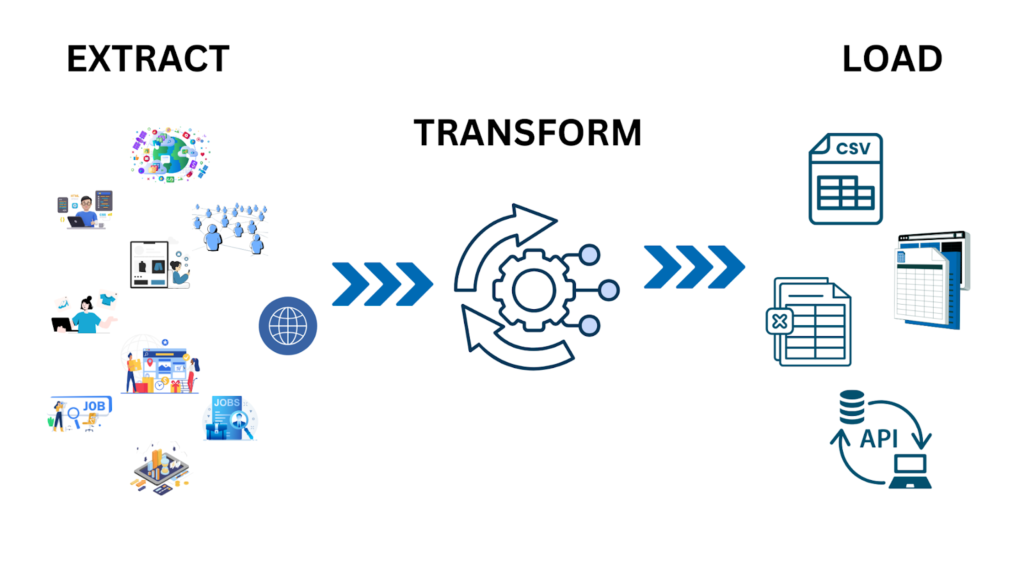

The financial services team extracts, tracks, and verifies key fund details while enriching investment models by analyzing vast amounts of unstructured data, such as bank accounts and debit or credit card transactions.

With well-structured and expertly annotated data, Coral Mountain Data supports enterprises looking to integrate AI into banking and financial operations. Our AI training data practice is grounded in a strong ethical framework, aligning with GDPR, CCPA, certification and compliance standards, as well as commitments to fair pay, diversity, and inclusion.

Office

Data Factory

Copyright © 2024 Coral Mountain Data. All rights reserved.