Harness AI-driven insurance solutions with our machine learning data to create a seamless, cost-efficient, and error-free ecosystem.

Leverage our annotation and labeling solutions to build competitive AI-enabled systems that streamline risk assessment, fraud detection, coverage determination, and error reduction—driving faster, smoother operations across applications, asset management, documentation, insurance coverage, and claim settlement.

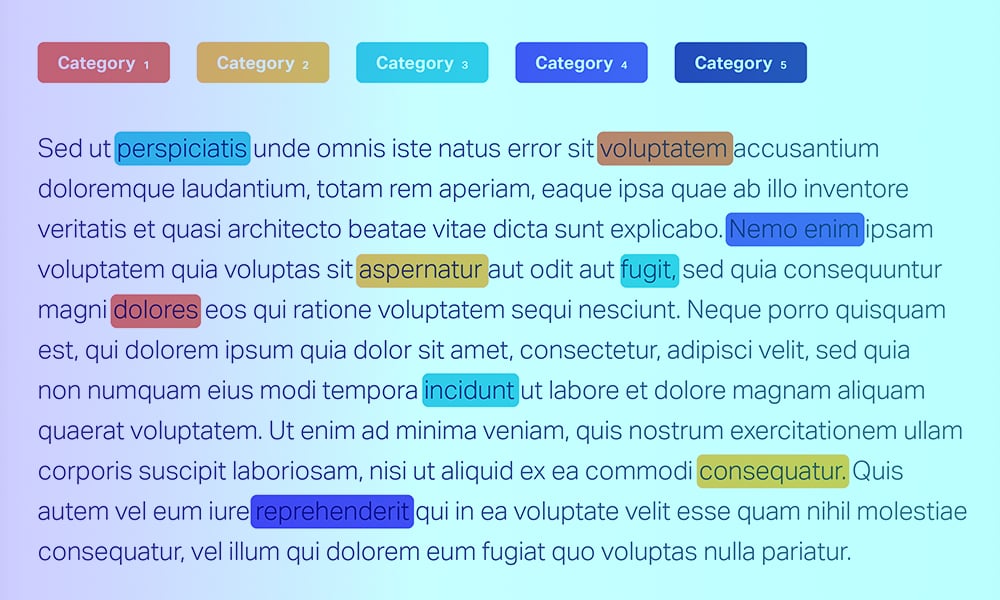

Leverage our NLP expertise in text annotation to build omnichannel conversational interfaces and chatbots that deliver fast, easy-to-understand Q&A experiences. Customers receive accurate answers instantly—without waiting for a representative.

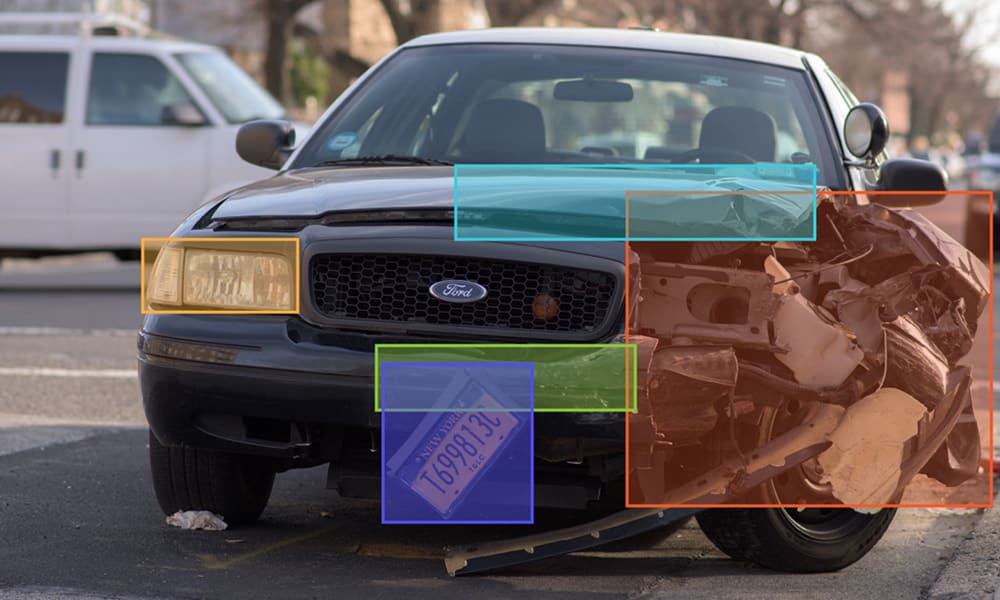

A technique for insurance AI tools that accurately assesses vehicle conditions, dents, and damages—enabling precise premium pricing and fair claim settlements.

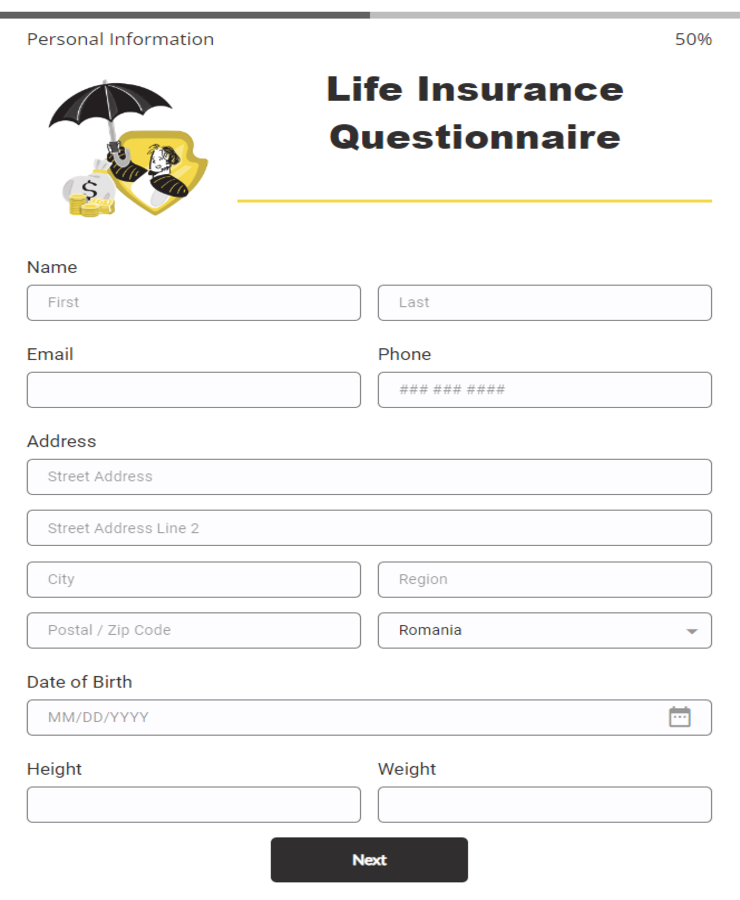

Our data training experts provide solutions that power AI products to filter key insights for smarter decision-making. Understand the specific habits of insurance buyers before qualifying them, setting premium prices, and settling claims.

Data annotation and labeling can transform the insurance industry, making it more efficient, accessible, and customer-friendly. Explore the examples below to see how our solutions can add value for both insurers and policyholders.

Partner with Coral Mountain Data to unlock AI-first insurance solutions that elevate customer experience. Our AI training data practices are built on a strong ethical foundation, ensuring GDPR and CCPA compliance, industry certifications, fair pay, diversity, and inclusion.

Office

Data Factory

Copyright © 2024 Coral Mountain Data. All rights reserved.